I've recently been doing some thinking about health care, and my thoughts aren't yet complete. However, when reading many of the

conservative commentaries on health care, I was very peeved by their treatment of the market for health care just like the market for any other good or service, and this was aggravated by the fact that I agreed with most of their other arguments. As a result, I wrote the following NextGen article to collect my thoughts on this issue before I move on to more substantive analyses of some

recent posts.

..................................................

"Healthcare and Cars: Why They're Not the Same"

How is the market for health care different from that for cars? And how does this difference change our understanding of health care policy?

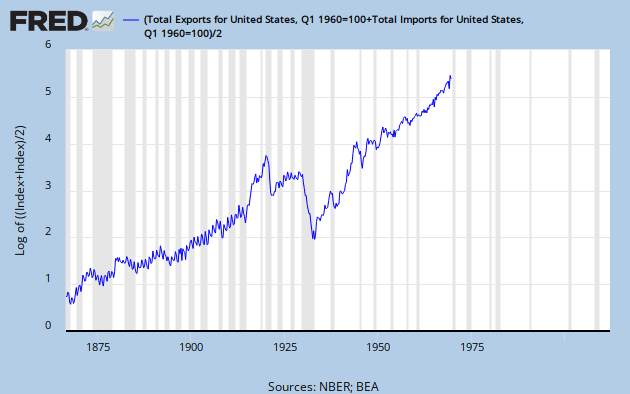

Let us start from the basics: health care is a service, while a car is a good. While this does not prevent market competition from improving society's welfare on the margin, it does mean that there are fundamental limits to how far the market can improve. In particular, it means that one productive hospital cannot simply “export” its health care services across the country. And as we know from the car industry and

international trade theory, that lack of export markets and distant competitors can impede the creative destruction that makes markets work.

But this is an incomplete justification. Haircuts are also services, but few people think barbershops require regulation. Yet, they differ in one key respect. While it is easy for me to determine the quality of my haircut, it is much more difficult for me to determine what counts as “good” health care. A large part of this is linked to the uncertainty inherent in any kind of biological process. How does one determine if one is receiving sufficient care? Of course, if there is any gross negligence, it can be detected. Yet if the care is just slightly worse than it should be, there's no real way for the consumer to know. The problem is compounded by the fact that most people rarely get sick. If you go to get a haircut every month, you can quickly determine which barbershop is the best. Unfortunately for neoclassical economists but fortunately for society as a whole, people need catastrophic care substantially less often than they need haircuts, thereby impeding the market from finding the most efficient solution.

Chronic care does change the calculation, but it introduces other factors that again prevent the market for health care from functioning like the market for cars. To take a concrete example, consider the 40 million elderly individuals who

suffer from arthritis. Does it make sense to ask them to “shop around” to find the perfect hospital? Does it make sense to ask them to trust in an online service like Yelp to decide where to get care? And when they are fatigued by chronic pain, does it make sense to think they

can make the “optimal” choice, and not just the most convenient?

Other problems make it difficult for the market for health care insurance to function like a regular competitive market. Again, a parallel to the market for cars, in particular

used cars, is helpful. A problem with used car markets is that it's not entirely clear whether the car you wish to purchase is good or bad. This depresses the market value of used cars, both good and bad. But then producers of the more expensive good cars exit the market, further lowering the average quality of a used car until the market spirals out of existence. The market for health care is subject to

similar pressures, but in the opposite direction. For insurers, they cannot easily tell whether an applicant is healthy or not. As a result, they charge the same premium to all individuals, which leads to healthy individuals dropping out of the market because they value the insurance less. This process repeats itself until premiums spiral upwards and no market for health care insurance exists.

This describes what economists call adverse selection, and although it is a market failure, it doesn't mean the government always needs to step in. However, understanding how the market circumvents the problem helps us understand why a simple solution for the health insurance does not exist. For example, markets for used cars can exist because the salesmen can offer warranties, so that if the car does break down you can “turn back the clock” on the purchase and return the car. This reduces the incentive for used car salesmen to trick you into buying lemons, because if the car does turn out to be a lemon you can always return it.

But what would a similar system mean for health care insurance? In that market, it's the consumer who has the private knowledge, therefore it falls to the consumer to make the “warranty”. This would mean the consumer would have to be able to guarantee that he or she won't become more unhealthy in the future – an impossible task. Alternatively, insurance companies can “turn back the clock” and refuse to pay for the consumer on the ground that the consumer was unhealthier than was expected. This hardly seems like an efficient or moral outcome, and is precisely the reason why the protections for preexisting conditions is so popular in the ACA.

With these stylized facts, it should be abundantly clear that the markets for health care and insurance are very different from what the standard competitive model predicts. Hence, we need to be very cautious when we draw glib analogies from health care to cars. However, the implications for policy are mixed. On one hand, certain

regulatory reforms such as cutting the employer health care deduction, reducing occupational licensing barriers, and relaxing privacy laws can result in substantial advances towards improving health care. Yet the presence of these government failures does not mean that there is no role for the government to ameliorate the market pathologies that I have listed above.

A notable example of this is the individual mandate. The individual mandate, by forcing people to purchase insurance, massively expands the market for health care. In doing so, this increases the incentive for firms to pursue innovative new projects to increase productivity. And even though consumers still rarely need catastrophic care, the larger market allows transparency and reputation to have an effect as hospitals are at greater risk to lose customers. For the insurance market, an individual mandate can help pull us away from the adverse selection death spiral by preventing self selection and thereby keeping most of the population insured.

In other words, the government is not perfect, but neither is the market. By noting that the market for health care is fundamentally different from that for other goods such as cars, we can recognize why the standard assumptions for regular markets may not apply in the case for health care. As such, we must move forward with caution, with an understanding that true reform lies not with complete liberalization or complete regulation, but rather with a judicious mix of the two.

......................

Update 10/24/12 -- I was pleasantly surprised to find that this post was heavily discussed in

Reddit. I just wanted to put a few points to defend myself from a series of very informative critiques.

- I never oppose market reforms like HSA's or cutting the employer healthcare tax deduction. That's not in my post at all.

- The point of the post is to highlight some frictions in the healthcare market that justify some sort of intervention -- market based (preferably) or command and control (not ideal).